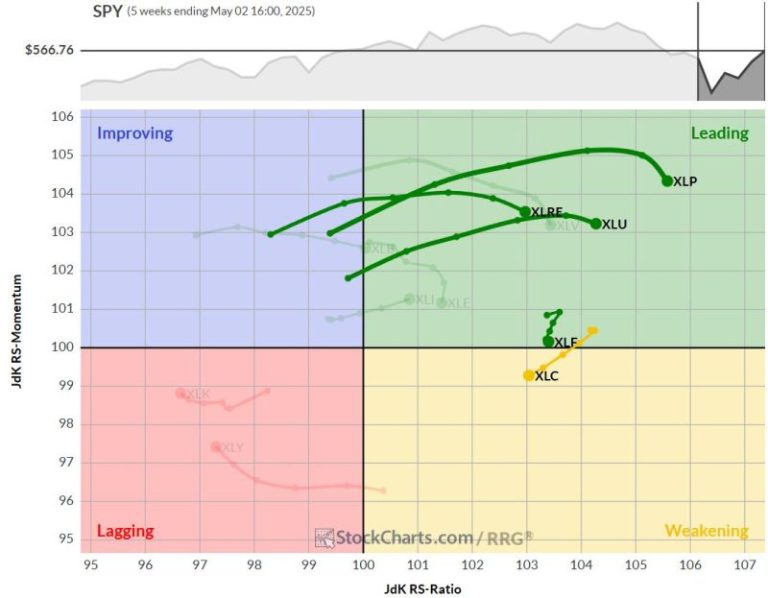

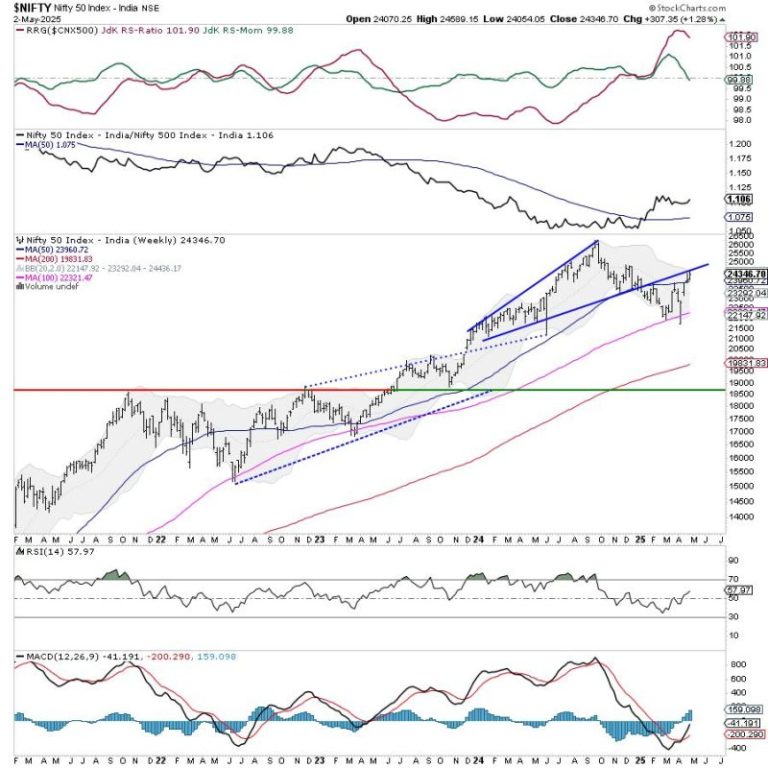

Riches are found in reactions—your reactions to changes in the markets. By this, I mean that if you spot a change in money flowing from one asset class to another, one sector to another, one industry to another, before the masses notice, you will be rewarded handsomely. My experience has been that your profits will accumulate dramatically and consistently.

A fine example of this principle in the corporate arena is the global footwear and accessories retailer, Aldo. The company has 1,600 stores in 80 countries and is immensely profitable. Their secret sauce: quick reactions to market trends. When they identify a change in fashion trends, they’re 50 percent quicker than their competition in designing, producing and delivering the hottest styles. Yes, fifty percent faster, and that’s gold to their bottom line.

This can be your secret sauce to investment profits as well. Your personal portfolio of ChartLists is the equivalent of Aldo’s design department, production department, and delivery department all bundled together. It facilitates quick reactions to current observable stock market opportunities.

In simplistic terms, your personal collection of ChartLists is like giving a runner a bicycle or giving a Jeep driver a Porsche. ROI (return on investment of your time and efforts) becomes supercharged. Your ChartLists allow you to become a “force of consistency.” They will also help you embrace one of Charlie Munger’s key investment tenets, “Try to be consistently not stupid.”

To achieve this end, I humbly suggest that you could best start with the Stock Market Mastery ChartPack.

Assembling your portfolio of ChartLists is analogous to building your custom dream house. There are sensational books of checklists that systematically ask you a comprehensive series of questions and bring up features you should consider. The end result should be a custom home you love, that fits you perfectly, and that accommodates your unique lifestyle. Think of the Stock Market Mastery ChartPack, then, as an extensive checklist—a buffet of pre-populated and organized ChartLists, from which you build your own custom collection of ChartLists that fits your investing methodology perfectly and facilitates your personal Investor Self. These 80 ChartLists are carefully structured, all pre-populated with expertly designed charts and a carefully-crafted organization to maximize your precious time and insights. Indeed, nearly all the informational breadcrumbs the market has to offer will be made clear to you and offer you a profitable trail to follow. Your reflexes and reactions just got supercharged. It is that easy.

Trade well; trade with discipline!

Gatis Roze, MBA, CMT

StockMarketMastery.com

- Author, “Tensile Trading: The 10 Essential Stages of Stock Market Mastery” (Wiley, 2016)

- Developer of the “Stock Market Mastery” ChartPack for StockCharts members

- Presenter of the best-selling “Tensile Trading” DVD seminar

- Presenter of the “How to Master Your Asset Allocation Profile DVD” seminar